| Feature | Partial Prepayment | Full Prepayment |

|---|---|---|

| Meaning | Pay only part of the remaining principal | Pay the full outstanding loan at once |

| Benefit | Lowers interest and may reduce EMIs/tenure | Ends the loan early and saves the most interest |

| Charges | Small fees may apply | Usually 2–5% of the balance |

| Flexibility | Can be done many times (as per lender rules) | One-time closing |

| Best For | People with extra money sometimes | People who have enough savings to close the loan |

Personal Loan Pre-Payment Calculator

What is a Prepayment Calculator for Personal Loan?

Do you have an unexpected cash inflow and don't have plans to use it? Why not pay off your personal loan? Tata Capital allows you to prepay your personal loans even before the loan tenure ends. You can prepay your personal loan in part or full depending on your preference.

Personal Loan Prepayment Calculator

Tata Capital's personal loan prepayment calculator helps you see how much you can save by paying off your loan early. Just enter your loan amount, interest rate, and the amount you want to prepay. The personal loan prepayment calculator will instantly show how your EMI, total interest, and loan tenure change. It's a simple way to plan smarter, reduce interest costs, and close your loan sooner without guesswork.

Disbursement Date

Disbursed Loan

Part Prepayment Date

Current Part Payment

Sum of Past Prepayments

25% of the disbursed amount

(No Charges applicable)

Chargeable Part Prepayment Amount

Within 25% of Disbursed Loan Amount

Final Part Payment Charges

Disclaimer: The aforementioned values, calculations and results are for illustrative and informational purposes only and may vary basis various parameters laid down by Tata Capital.

How to use a Personal Loan Pre-Payment Calculator

You can use the part payment personal loan calculator by following the steps mentioned below:

Note: You can either use the ‘+’ or ‘-‘ symbols to increase or decrease the amount. Alternatively, you can even enter the amount manually in a box

What are the Benefits of Pre-Paying your Personal Loan?

Pre-payment of Personal Loan, both full and in part comes with several benefits, as mentioned below-

What are the Pre-Closure charges in a Personal Loan?

A part prepayment of personal loan amount of upto 25% of the principle outstanding is permitted. You will be levied pre-closure charges as 4.5% (on the amount over and above 25% of Principal outstanding).Note– You can apply for part pre-payment of your personal loan only once a year. To know more about the personal loan pre-closure charges, visit our personal loan charges and fees page

Tips for Maximising Savings on Prepayment Calculations

Start Early: Try to make prepayments in the first few months of your loan. Most interest is charged at the beginning, so even a small early payment can save a lot.

Check the Lender's Rules: Some lenders have a waiting period or charge a fee for prepayment. Always check the terms so you don't lose money on penalties.

Pay Extra Whenever Possible: Small, frequent part-payments can reduce your principal loan amount and lower future EMIs.

Compare Lenders: Prepayment policies differ from lender to lender. Choose one that offers flexible or low-cost prepayment options.

Use Bonuses Wisely: Put part of your bonus or refund toward your loan to reduce debt faster.

Factors Affecting Personal Loan Prepayment

1. Taxation: Personal loan prepayment can reduce or remove any tax benefits you were earlier claiming. If you pay off the full loan, you lose tax deductions completely. With part-prepayment, these benefits reduce.

2. Interest Rate: Since personal loans usually have higher interest rates, paying off the principal early can help you save a good amount. A personal loan part payment calculator can show how much interest you can cut down.

3. Timing: Prepaying in the early months of your loan saves more because that's when interest is highest. Prepaying later gives fewer benefits.

4. Extra Charges: Lenders may add a prepayment fee (often around 2%) to cover their lost interest.

Partial vs. Full Prepayment of Personal loan

When you want to reduce your personal loan burden, you can choose either partial or full prepayment. Both options help you save interest, but they work in different ways.

Personal Loan Pre-Payment Calculator FAQs

Can I save money by making pre-payments of personal loan?

What are the benefits of using the Tata Capital's personal loan pre-payment calculator?

Pre-payment of a personal loan, both in full and in part, has various advantages, as listed below.

#1 Become Debt-Free Faster: Repaying your personal loan before its due date, whether in part or in full, allows you to become debt-free faster. However, a nominal pre-payment fee will be charged.

#2 Good credit score: Both full and partial prepayment of a personal loan help improve your credit score in the long run. This is because it will allow you to pay off the outstanding principal amount on time, which will reflect well on your credit history.

#3 Reduced interest payment: You can save money on interest by making a partial or complete pre-payment. This is because when you prepay your loan partially, the overall EMI reduces. And this means you now have to pay a lower interest on your outstanding amount.

How accurate is the personal loan pre-payment calculator in estimating savings?

A personal loan EMI calculator with prepayment accurately calculates your revised EMI, revised tenure, total payment and remaining principal on the basis of the values you enter. However, it cannot estimate your savings. This is because to calculate your savings, you need to take into account other factors, such as the prepayment charges.

To estimate your savings, you can compare the results of the personal loan EMI calculator with prepayment with the amount you would pay if you don't prepay the personal loan.

Do personal loans have prepayment penalties?

Pre-payments of personal loans can only be made once a year (with a maximum of 50% of the principal outstanding)

There should be with a minimum of six months between two consecutive pre-payments.

No pre-payments can be made during the lock-in period (first 12 months)

The minimum part pre-payment amount must be equal to or higher than 2 months’ EMI

Charges for pre-paying your personal loan are only levied if you pre-pay more than 25% of the principal outstanding. In this case, a pre-closure charge of 4.5% + GST (on the amount over and above 25% of the Principal outstanding) will be charged. Other than this, keep the following in mind while planning the pre-payment of your personal loan.

How many times can prepayment be done?

No, you cannot adjust the frequency of pre-payments in the calculator. You can only adjust the following.

Loan amount

Loan duration

Rate of interest

Part payment amount

Payment months

Based on the above values, Tata Capital’s pre-payment calculator will display the revised EMI, revised tenure, total payments and remaining principal.

However, it’s important to note that you can make a pre-payment only once a year with a gap of a minimum of six months between two consecutive payments.

How can I use the pre-payment calculator to plan my loan repayment strategy?

Tata Capital’s pre-payment calculator helps you plan your loan repayment strategy by calculating revised EMIs and tenures under varying conditions quickly and accurately. Here’s how to use it.

Use the first slider to specify your loan amount

Use the second slider to specify your loan duration in months or years

Use the third slider to specify the interest rate

Use the fourth slider to specify the part payment amount

Use the last slider to specify the payment months

Once you’ve completed the above steps, the pre-payment calculator will automatically calculate your revised EMIs, revised tenure, total payment and remaining principal. You can keep readjusting the above values to find a repayment plan that works for you.

Does the calculator take into account the interest saved by pre-paying?

No, the calculator cannot take into account the interest saved by pre-paying your loan. However, it can help you calculate the revised EMI and revised tenure. Here’s how you can calculate these.

Use the first slider to specify your loan amount

Use the second slider to specify your loan duration in months or years

Use the third slider to specify the interest rate

Use the fourth slider to specify the part payment amount

Use the last slider to specify the payment months

You can also use the ‘+’ or ‘-‘ symbols to increase or decrease the amount. Alternatively, you can even enter the amount manually in a box. Based on these values, Tata Capital’s pre-payment calculator can calculate your revised EMI, revised tenure, total payment and remaining principal.

Can the pre-payment calculator be used for all types of personal loans?

Yes, Tata Capital’s pre-payment calculator can be used for the calculation of all types of personal loans such as

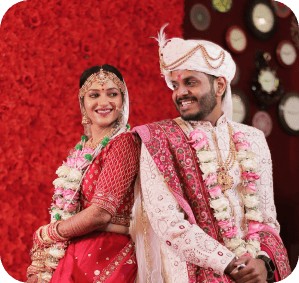

#1 Personal Loan for Education

#2 Personal Loan for Travel

#3 Personal Loan for Medical

#4 Personal Loan for Marriage

#5 Personal Loan for Home Renovation

All you need to do is enter the loan amount, loan duration, rate of interest, part or pre-payment amount and payment months to know your revised EMI and revised loan repayment tenure.

Can I calculate the potential savings by making multiple pre-payments?

Yes, you can calculate your potential savings by making multiple pre-payments through Tata Capital’s pre-payment calculator. While the calculator won’t calculate your potential savings explicitly it can help you calculate your revised EMIs and tenure.

And you can compare these results with the amount you would pay if you don’t make multiple pre-payments. Here’s how to use it.

Use the first slider to specify your loan amount

Use the second slider to specify your loan duration in months or years

Use the third slider to specify the interest rate

Use the fourth slider to specify the part payment amount

Use the last slider to specify the payment months

You can also use the ‘+’ or ‘-‘ symbols to increase or decrease the amount. Alternatively, you can even enter the amount manually in a box. Based on these values, Tata Capital’s pre-payment calculator can calculate your revised EMI, revised tenure, total payment and remaining principal.

What is a Part Payment Calculator?

A Part Payment Calculator helps you determine the impact of making a partial prepayment on your loan. It shows how the prepayment reduces the outstanding loan amount, EMIs, or tenure.

How Does the Part Payment Calculator Work for a Personal Loan?

The Part Payment Calculator requires details like outstanding loan amount, interest rate, EMI, and prepayment amount. Based on this, it calculates how the prepayment affects EMIs or loan tenure, showing potential interest savings.

Does Prepayment Improve CIBIL Score?

Yes, prepaying a loan can positively impact your CIBIL score. It reduces your outstanding debt and improves your credit utilisation ratio, which lenders consider when evaluating creditworthiness.

Are There Any Limitations or Factors to Consider When Using a Personal Loan Part Payment Calculator?

Yes, some factors include prepayment charges, lender policies, and the stage of loan repayment. Some banks charge fees for prepayment, which may reduce the expected savings. Also, prepayments made early in the tenure yield more benefits than those made later.

Can I Make Multiple Part Payments on My Home Loan, and How Does It Affect the Tenure?

Yes, multiple part payments are allowed based on lender policies. Making frequent prepayments reduces the outstanding principal, which lowers interest costs and shortens the loan tenure.

Can I make multiple part payments on my home loan using the prepayment calculator?

Yes, you can. A prepayment calculator lets you add multiple part payments to see how each one reduces your loan amount, interest, and overall tenure. You can enter different amounts and dates to understand how regular extra payments help you close the loan faster.

How is the interest saved calculated in home loan prepayments?

Interest saved is calculated by checking how much interest you would have paid without prepayment and comparing it with the new total after making extra payments. When you reduce the principal early, the remaining interest reduces sharply. The calculator shows this difference as your total savings.

More Personal Loan products for you

What our customers say about us

Find the right Loan for you

Blogs

Last updated on: 18 Feb, 2026

SMS sent successfully!

SMS sent successfully!

Click allow button to receive notifications

Click allow button to receive notifications