Tata Capital Moneyfy

Wait Mat Karo, ELSS Me Invest Karo!

Invest ₹ 1.5 Lacs & save tax up to ₹ 46,800*

Personal Loan

Pay interest only on the amount used

with a Personal Loan Overdraft like facility

Get the Tata Capital App to apply for Loans & manage your account. Download Now

All you need to know

Personal loan for all your needs

Higher credit score increases the chances of loan approval. Check your CIBIL score today and get free insights on how to be credit-worthy.

Check Credit ScoreHome Loan with instant approval starting

@ 8.75% p.a

All you need to know

Home Loan for all your needs

Calculators

Business loan to suit your growth plan

All you need to know

Business loan for all your needs

Get secured business loans with affordable interest rates with Tata Capital. Verify eligibility criteria and apply today

Know MoreExplore Used Car Loans

Explore Two Wheeler Loans

Calculators

Avail Loan Against Securities up to ₹40 crores

All you need to know

Explore Loan Against Securities

Calculators

Higher credit score increases the chances of loan approval. Check your CIBIL score today and get free insights on how to be credit-worthy.

Check Credit ScoreAvail Loan Against Property up to ₹3 crores

All you need to know

Loans for all your needs

Calculators

All you need to know

Calculators

All you need to know

Digital financial solutions to aid your growth

Most Popular products

Most popular products

Financing solutions tailored to your business needs

Our Bestselling Products

Avail Term Loans up to Rs. 1 Crore

Ensure your business’ operational effeciency with ease

Most Popular products

A personal finance app, your one-stop shop for comprehensive financial needs - SIP, Mutual Funds, Loans, Insurance, Credit Cards and many more

Calculators

All you need to know

Wealth Services by Tata Capital

Personalised Wealth Services for exclusive customers delivered by a team of experts from a suite of product offerings

Calculators

All you need to know

Protect your family against unforeseen risks

Avail any of the Insurance policies online in just a few clicks

Bestselling insurance solutions

Quick Links for insurance

Motor Insurance

Life Insurance

Health Insurance

Other Insurance

Investment

Protect your family against unforeseen risks

Avail any of the Insurance policies online in just a few clicks

Choose from our list of insurance solutions

Quick Links for insurance

Motor Insurance

Life Insurance

Health Insurance

Other Insurance

Investment

Equipment Finance

Equipment Leasing

Construction Financing

Tata Capital Moneyfy

Invest ₹ 1.5 Lacs & save tax up to ₹ 46,800*

Personal Loan

with a Personal Loan Overdraft like facility

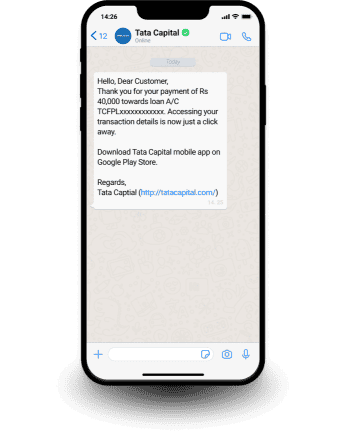

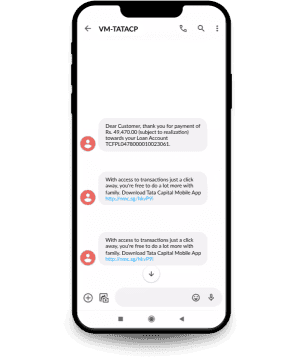

Get all the information for your Tata Capital Loan through any of the platforms below

Good service for two wheeler loans. Thanks, Tata Capital.

Two Wheeler Loan | 18 February, 2024

Customer Service was excellent and helpful.Thanks.

Personal Loan | 17 February, 2024

Good and helpful service. Your co operation is excellent. Thank You.

Personal Loan | 17 February, 2024

Excellent and quick service response. Thanks for prompt action.

Personal Loan | 17 February, 2024

Entire Service is very professionally organised. Thanks a lot.

Business Loan | 15 February, 2024

Excellent service and very fast response. Really appreciate. One of the Best service that I have dealt with.

Personal Loan | 15 February, 2024

Good service ,very quick process , good staff behaviour,I’m satisfied with Tata capital. Keep it up.

Two Wheeler Loan | 13 February, 2024

All perfect no suggestions required. Proud on Tata Group as an Indian.

Two Wheeler Loan | 08 February, 2024

Excellent company and response is so good.

Personal Loan | 08 February, 2024

Read All

Important Information

Investor Information

Policies, Codes & Other Documents

Tata Capital Solutions & Services

Personal Loan

Business Loan

Vehicle Loans

Uh oh, something went wrong

Please try again later.

Start an SIP in minutes by signing up with the Tata Capital Moneyfy App. We are your one stop shop for all things investment.

Looking for a seamless loan experience? Get the Tata Capital Loan App and Apply for loans, Download Account Statement/Certificates, Track your requests & much more.

Thank you for subscribing

We will send news and updates to your registered email ID

We are constantly crafting offers and deals for you. Get them delivered straight to your device through website notifications.

All you have to do is Click on “Allow”

rahul.sharma@gmail.com