Factoring

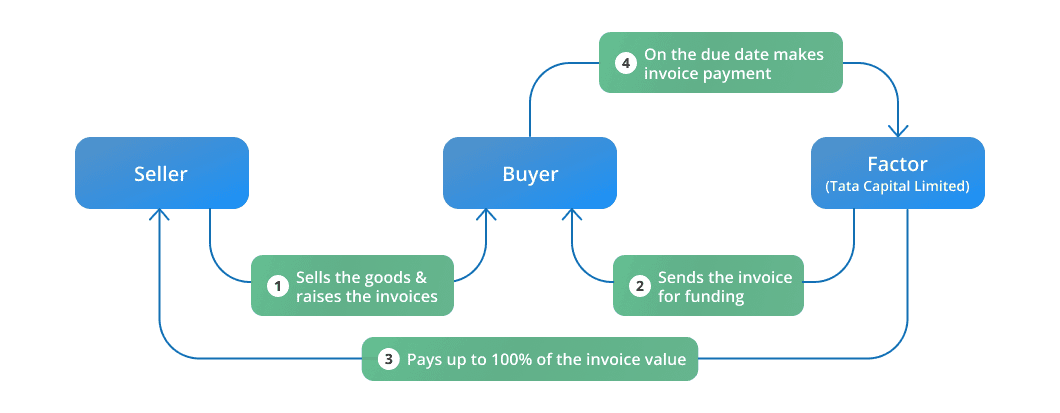

Factoring is a dynamic financial solution tailored for businesses to optimize their cash flow by converting receivables into immediate liquidity.

Tata Capital’s Factoring services allow seller to sell outstanding invoices at a discount, ensuring timely access to funds. This innovative offering helps streamline operational expenses, invest in growth, and reduce credit risks.

With Tata Capital’s tech-enabled platforms and customized support, you can efficiently manage receivables, strengthen business liquidity, and focus on expanding your business network.

| Particulars | Channel Finance |

|---|---|

| Customer ROI | 9.00% - 21.00% |

| Processing Fees |

Minimum 1% of Sanctioned Amount |

| Stamp Duty | As per Stamp Duty Circular, Varies from State to State |

| Foreclosure Charges | Upto 6% |

Default in payment of interest and/or principal amounts, Below charges on the defaulted amount

| Overdue Days | Penal Charges |

|---|---|

| 1-30 days | 4% p.a |

| 31-60 days | 8% p.a. |

| 61- 90 days | 12% p.a. |

| Greater than 90 days | 24% p.a |

(ii) Dishonour Charges: Rs. 670/- (Rupees Six Hundred and Seventy Rupees only) for every Cheque/ Payment Instrument/ ECS Dishonour.

(iii) Non-creation/perfection of security: @ 2% on the outstanding principal amount will be charged for the period of delay in respect of delayed/non-submission of security/collateral related documents and non-perfection of security.

*Charges to be paid along with applicable Tax

| Description | Periodicity | Penalty Amount |

|---|---|---|

| Delayed/non submission of stock statement | To be submitted Quarterly by 10th of every Calendar Quarter. | Additional one time charge of Rs 20,000/- per Quarter |

| Delayed First Insurance cover note and non renewal of Insurance on due date |

First Insurance:- within 30 days from disbursement date. Renewal : as and when due |

Additional one time charge of Rs 20,000/- per financial year |

| Non adherence of financial covenants’ of sanction letter | At the time of Review /Renew of account | Additional one time charge of Rs 20,000/- per financial year |

| Documentation charges | Rs 5,000/- | |

| Stock Audit charges | Rs 5,000/- | |

| ROC and CERSAI filling | Rs 5,000/- | |

| Valuation charges | As per actuals | |

| TSR fees / Title search fees | As per actuals | |

| Security trust fees | As per actuals |

Charges to be paid along with applicable Tax

Here’s why you should choose Tata Capital to get a Factoring for your business:

At Tata Capital, we provide several types of working capital loans to cater to the precise needs of business owners. You can choose from the following working capital solutions: