Union Budget 2023 - Income Tax

Impact on Salary Deduction

This product offering is currently unavailable. We will be back soon. Till then please explore our other products.

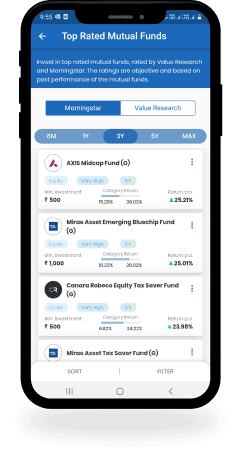

Mutual funds hold incredible growth potential for your money. Choose from our handpicked selection of the most rewarding schemes. Analyse, compare, and track top mutual fund investments at Moneyfy.

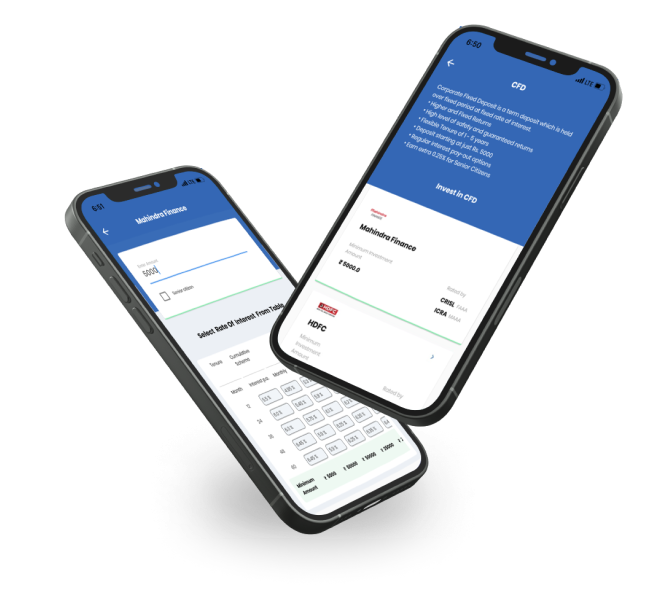

These term deposits offer a fixed interest rate over a flexible tenure ranging from 1-5 years.

Fulfill your most cherished life goals with our suite of financial products. Buy the house of your dreams, pay for your education, build a solid retirement corpus – do it all at Moneyfy.

Identify top Mutual Fund performers and park your money in the best schemes

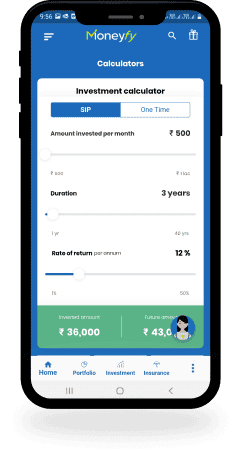

Use our calculators to plan your growth journey

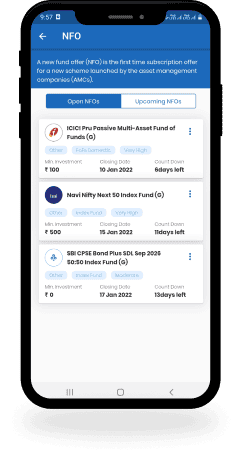

Invest in New Funds offer (NFOs) from various AMCs

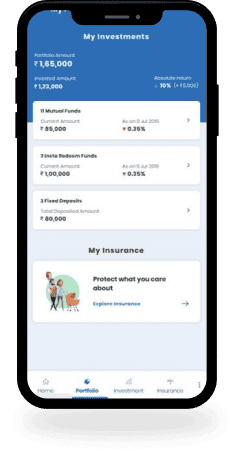

Track your investment portfolio with a simple and easy interface

Identify top Mutual Fund performers and park your money in the best schemes

Use our calculators to plan your growth journey

Invest in New Funds offer (NFOs) from various AMCs

Track your investment portfolio with a simple and easy interface

Monitor your portfolio in just a single click. Have access to all your investments on your fingertips!

We give you the tools to invest in a proactive and responsible manner. Use our comparison and scanner tools to search & filter products.

Say goodbye to monthly SIP reminders. Enable Auto Pay and grow your wealth hassle-free.

Have any queries? Call us at 1860 266 1996 for quick support services.

With strong digital protocols and authorization, investments are completely secure on our Moneyfy platform.

Register your mobile number and email ID with Moneyfy

Set up your account and update your KYC details

Once we verify your KYC details, you’re ready to start investing!

Click the “Allow” button to receive notifications

We're constantly crafting offers and deals for you. Get delivered straight to your device through website notifications.

All you have to do is click on “Allow”.

Now keep a track on your favourite fund

Go to the watchlist page to remove a fund from the list.

No funds are added to watchlist

Add your favourate funds to watchlist to keep them handy

No funds are added to portfolio

Add your favourate funds to portfolio to keep them handy